AML Services Monitoring And Reviewer: What You Need To Know

Anti-Money Laundering (AML) services are crucial in today’s financial world. With the rise of digital transactions and online banking, the risk of money laundering and other financial crimes has increased significantly. AML services monitoring and reviewers play a key role in detecting and preventing these crimes. In this article, we will explore the importance of AML services monitoring and reviewing, and what you need to know about this essential aspect of financial compliance. Ну а подробнее читайте тут: https://amlscreening.center/

The Role of AML Services Monitoring

AML services monitoring is the process of tracking and analyzing financial transactions to identify suspicious activities that may indicate money laundering or other financial crimes. AML monitoring systems use advanced algorithms and machine learning technologies to flag potentially suspicious transactions for further review. These systems help financial institutions comply with regulations and safeguard against financial crimes.

AML services monitoring is a continuous process that requires real-time tracking and analysis of financial transactions. Monitoring systems can help detect patterns and trends in transaction data that may indicate potential money laundering activities. By detecting and reporting suspicious transactions, AML monitoring systems help financial institutions prevent illegal activities and protect their customers and reputation.

The Role of AML Services Reviewer

AML services reviewers are responsible for reviewing and analyzing flagged transactions to determine whether they are legitimate or potentially suspicious. AML reviewers use their knowledge of financial regulations and criminal activities to assess the risk of each flagged transaction and determine the appropriate course of action. AML reviewers play a crucial role in preventing money laundering and other financial crimes by identifying and reporting suspicious activities to authorities.

AML services reviewers work closely with compliance and legal teams to ensure that financial institutions comply with regulations and policies related to money laundering and financial crimes. Reviewers must have a thorough understanding of AML regulations and guidelines to effectively evaluate and report suspicious transactions. By conducting thorough reviews of flagged transactions, AML reviewers help protect financial institutions from fraud and illegal activities.

Key Responsibilities of AML Services Monitoring And Reviewer

AML services monitoring and reviewers have several key responsibilities to ensure the effectiveness of AML compliance efforts. Some of the key responsibilities of AML services monitoring and reviewers include:

- Monitoring and analyzing financial transactions for suspicious activities

- Reviewing flagged transactions to determine their legitimacy

- Reporting suspicious transactions to authorities

- Ensuring compliance with AML regulations and guidelines

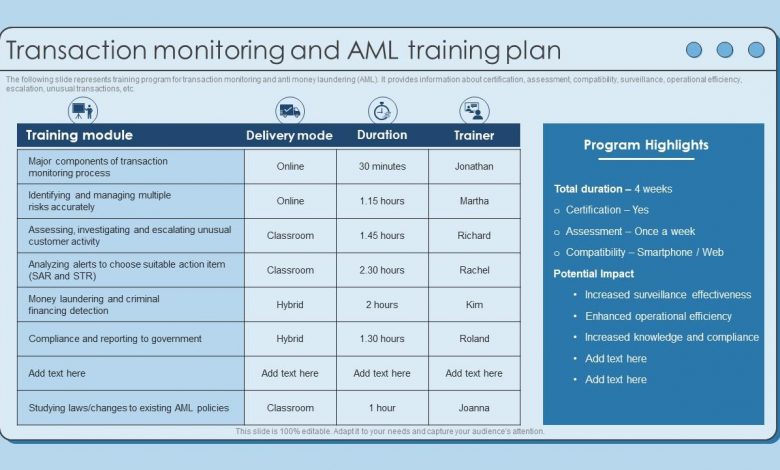

- Conducting ongoing training and education on AML compliance

By fulfilling these responsibilities, AML services monitoring and reviewers help financial institutions detect and prevent money laundering and other financial crimes. Their efforts are crucial in maintaining the integrity of the financial system and protecting customers from fraud and illegal activities.

Challenges in AML Services Monitoring And Review

While AML services monitoring and reviewing are essential for financial compliance, they also present several challenges. Some of the key challenges in AML services monitoring and review include:

- Managing large volumes of financial transactions

- Keeping up with rapidly changing regulations and guidelines

- Identifying and flagging potential suspicious activities accurately

- Balancing compliance requirements with operational efficiency

- Training and retaining skilled AML professionals

Overcoming these challenges requires a combination of advanced technologies, skilled professionals, and robust compliance programs. Financial institutions must invest in cutting-edge AML monitoring systems and provide ongoing training and education to AML reviewers to ensure effective detection and prevention of financial crimes.

Conclusion

AML services monitoring and reviewing are essential components of financial compliance. By tracking and analyzing financial transactions, AML monitoring systems help detect and prevent money laundering and other financial crimes. AML reviewers play a crucial role in evaluating flagged transactions and reporting suspicious activities to authorities. While there are challenges in AML services monitoring and review, financial institutions can overcome them by investing in advanced technologies and providing ongoing training to AML professionals. Overall, AML services monitoring and reviewing are critical in protecting the integrity of the financial system and safeguarding against fraud and illegal activities.